Mortgage Rates Feel Confusing? You’re Not Alone

By: Quoc Lam

If you’ve been watching the news lately, you might be thinking:

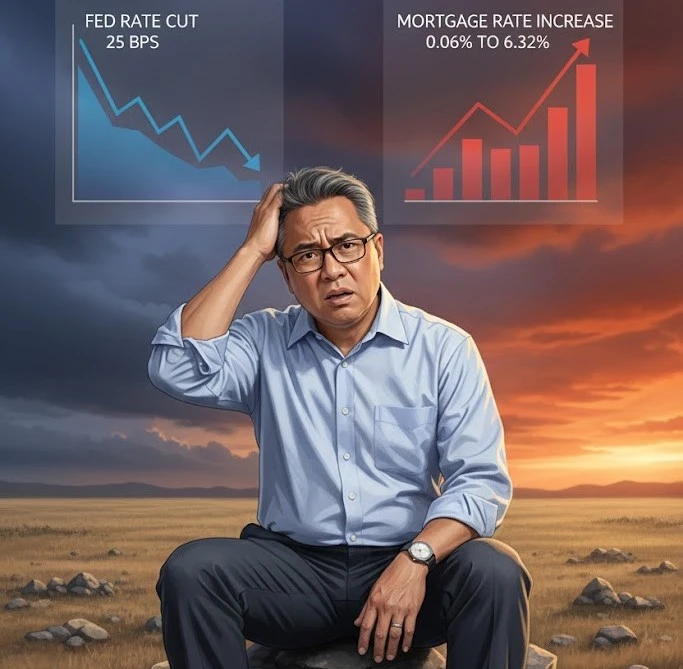

“The Fed cut rates… so why aren’t mortgage rates dropping like I expected?”

You’re not wrong to be confused — and you’re definitely not alone.

Mortgage rates have been a bit of a roller coaster recently. Even after positive economic news, rates moved slightly higher toward the end of the week. That can feel frustrating, especially if you’re planning to buy a home or refinance.

So let’s break it down in plain English.

Not All Rates Are the Same — And That Matters

One key reason for the confusion is that people often lump all ‘rates’ together, when in reality they are very different.

Here’s a simple comparison:

-

Fed Funds Rate

This is the interest rate for very short-term loans — usually 24 hours or less between banks. -

Mortgage Rates

These apply to long-term loans — up to 30 years for most homebuyers.

Because these loans operate on completely different time frames, their rates behave very differently.

Timing Is Everything

Another big difference is how often these rates can change.

-

The Federal Reserve only meets 8 times per year to decide whether to raise or cut the Fed Funds Rate.

-

Mortgage rates move daily — sometimes even multiple times in a single day — based on bond markets, inflation expectations, and investor sentiment.

This is why mortgage rates often move ahead of the Fed.

By the time the Fed officially announces a rate cut, mortgage rates may have already adjusted weeks — or even months — earlier.

Where Rates Are Right Now

Currently, 30-year fixed mortgage rates are sitting in the low-6% range. That’s not the highs of 2023, but it’s also not the ultra-low rates we saw a few years ago.

Instead of chasing headlines, what matters most is how today’s rates fit into your personal financial plan.

What This Means If You’re Buying or Refinancing

Trying to perfectly time the market rarely works. Smart homeowners focus on:

-

Monthly payment comfort

-

How long they plan to stay in the home

-

Loan structure and flexibility

-

Future refinance opportunities

At FOCI Loans LLC, we help clients look beyond the headline rate and focus on smart strategy — so today’s decision still makes sense tomorrow.

The Bottom Line

Mortgage rates and Fed rates are related, but they are not the same thing. They move on different timelines and respond to different forces.

Anyone claiming certainty about future rate movements is missing how unpredictable the market truly is. When they’re right, it’s rarely because they “knew” — it’s because they got lucky.

What doesn’t change is the value of clear guidance, honest conversations, and a plan built around you. Whether you’re buying, refinancing, or just trying to understand the market, the FOCI Loans team is here to help.